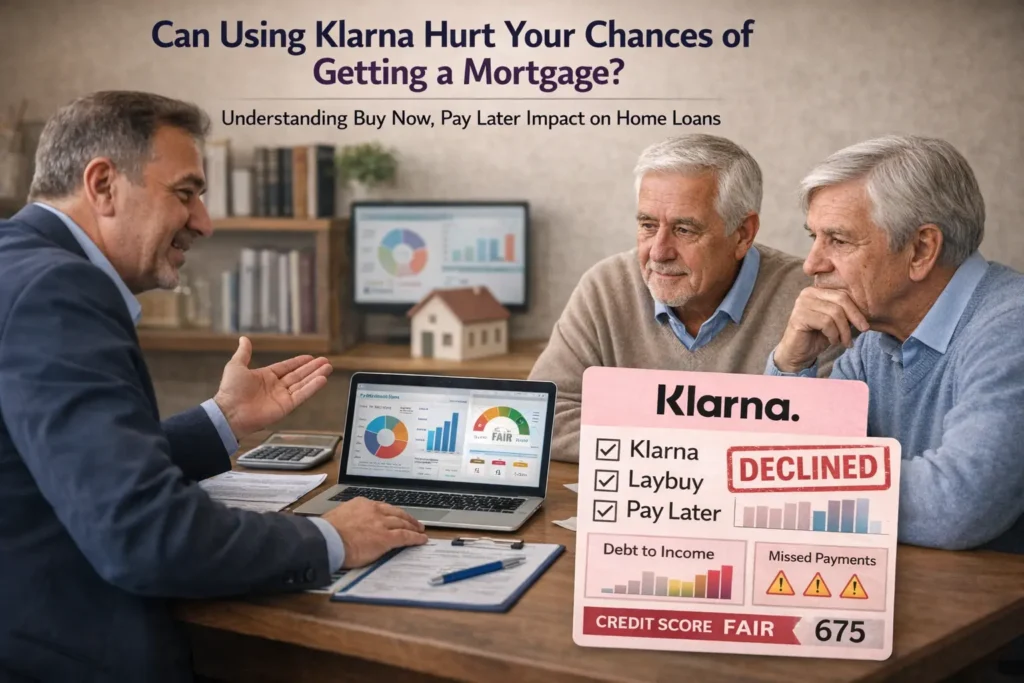

Can Using Klarna Hurt Your Chances of Getting a Mortgage?

The use of Klarna and other ‘buy now, pay later’ schemes has skyrocketed in recent years. While they have been useful for some consumers, it’s worth considering what impact using them can have if you need to apply for a mortgage in the near future.

Here, Lee Trett, director and co-founder of financial advisory service Money Helpdesk, breaks down what impact a history of Klarna usage can have on mortgage applications.

Will Klarna usage stop you from getting a mortgage?

According to Trett, who also founded lead-generation service LeadCrowd, Klarna usage won’t necessarily harm your chances of mortgage approval, but using it and similar services such as PayPal Credit, Laybuy, and Clearpay can have an impact on finance applications in a number of ways:

“Sometimes debts related to Klarna agreements will add to your debt-to-income (DTI) ratio, which measures disposable income with fixed outgoings factored in,” Trett explained. “A significant amount of debt from a Klarna purchase could push your DTI ratio up to a point where it’s harder to get a good mortgage deal.

“Furthermore, mortgage lenders will be able to see Klarna usage against your name when they assess your application, and some might see it as a minor red flag and be concerned that you are living beyond your means. This doesn’t mean they will reject you outright, but they may look into why you needed to use Klarna.”

Trett also cautioned Klarna users that irresponsible use of the service could affect their mortgage affordability and creditworthiness, so be sure to spend within your means and don’t miss any payments once you have entered an agreement.

“If you are tied into substantial Klarna payments for a long period, some lenders will class this as a fixed outgoing and offset it against your income when assessing your affordability, Trett added. “This could impact your maximum borrowing.

“On top of that, Klarna usage can have the biggest impact on your mortgage application if you have ever missed payments on an agreement with them. Some lenders will see this as a sign that you are not a responsible borrower.”

👉 You might also like: How to Start an Online Business With AI in 2026

When Klarna use isn’t an issue for lenders

The important thing to note is that, while Klarna can negatively impact a mortgage application, it is absolutely possible to get approved with it on your credit files.

Mortgage lenders will usually take a look into the circumstances surrounding your ‘buy now, pay later’ agreement, but there are times when it can be ignored entirely, such as:

- If you used Klarna as a one-off and paid the debt in full

- The Klarna usage is for a relatively small amount of money

- You have never missed any payments on the agreement

- The debt will be repaid before you complete on your mortgage, or shortly after

Trett concludes: “Although some lenders take a dim view of any Klarna use whatsoever, some mortgage providers will review it on a case-by-case basis and offer a mortgage with no caveats.”

Can Klarna usage ever be beneficial to a mortgage application?

There are rare instances where it can be. If you were to enter a ‘buy now, pay later’ arrangement with Klarna and make the repayments in full and on time, this will help you build some credit history, and this can be beneficial for a mortgage application, as Trett explains.

“If you are applying for a mortgage with no or limited credit history, responsible Klarna usage can be helpful, but keep in mind that there are lenders who won’t want to see any at all,” he said.

“Klarna does not perform a hard credit check for ‘buy now, pay later’ deals, but this isn’t the case when taking out financing, so be aware that this can impact your credit reports.”

✨ You’re one follow away from daily smarter thinking, follow Tech Statar.